Torsten Asmus/iStock via Getty Images

Dear Partners,

While individual client returns may differ based on their inception dates, consolidated performance of all accounts for the period ending December 31, 2024 is as follows:

|

Q4 2024 |

2024 |

2023 |

2022 |

2021* |

|

|

White Falcon (net of fees) |

5.5% |

14.4% |

36.0% |

-9.3% |

-1.5% |

|

S&P 500 TR (CAD) |

8.9% |

35.2% |

23.2% |

-12.6% |

3.3% |

|

MSCI All Country TR (CAD) |

5.0% |

26.3% |

18.5% |

-11.9% |

1.5% |

|

S&P TSX TR |

3.8% |

21.7% |

11.8% |

-5.8% |

-0.6% |

|

*Performance is from Nov 8 – Dec 31, 2021 |

We had a good year on an absolute basis. However, after two years of outperformance against the popular indices we could not keep up with a fast charging market. While we didn’t experience significant losses, we also didn’t see standout gains. As much as we would like our stocks to move on a calendar basis, we cannot control market timing! We like what we own and maintain that the portfolio is well-positioned with a significant margin of safety.

As we reflect on performance, this year marks the completion of three full fiscal years for White Falcon. From the outset, we’ve consistently emphasized that we do not manage our portfolio with the goal of tracking or outperforming an index. Instead, our focus remains steadfastly on achieving absolute returns. That said, if our positions were reversed, I would naturally want to assess whether the White Falcon portfolio is competitive with broader market returns. While this may seem straightforward, it is one of the most nuanced and challenging aspects of investment management. What constitutes “the market”? Is it the S&P 500 (SP500, SPX) , the TSX, the Russell 2000 (RTY) or some blend of these three? How do you measure the risk taken to achieve those returns? And just as importantly, how long should one evaluate manager performance to distinguish between skill and luck?

While there are no ‘right answers’, we believe that partners should compare our results against their opportunity costs. More significantly, we maintain that at least a decade is required to meaningfully assess whether a portfolio manager possesses true investment skill.

Of course, the long term is ultimately built on a series of shorter time periods. Below, we present our three-year return and commit to sharing rolling three-year returns going forward.

|

Three Year Cumulative* |

Three Year CAGR* |

|

|

White Falcon (net of fees) |

40.31% |

11.95% |

|

S&P 500 TR (CAD) |

44.08% |

12.95% |

|

MSCI All Country TR (CAD) |

30.67% |

9.33% |

|

S&P TSX TR |

27.85% |

8.54% |

|

Asset Allocation/Advisor Model |

||

|

Blackrock Core Equity ETF (XEQT) |

29.97% |

9.13% |

|

*Three years ending Dec 31, 2024 |

The above shows that an investment of $1.0 million in White Falcon three years ago has now grown to $1.4 million as at December 31, 2024 after all fees and expenses.

We have managed to do well but have been bested by the S&P 500 index in Canadian Dollar (CAD) terms . While this may bruise my ego, it’s important to take a step back and provide some context.

Currencies have played a big part for Canadian investors like us investing in the U.S.! Over the past three years, the S&P 500 has delivered a total return of 28.6% in U.S. Dollars (‘USD’). However, due to the 15.5% depreciation of the Canadian Dollar (CAD) during this period, its return in Canadian Dollars (CAD) has been significantly higher at 44.08%. The White Falcon portfolio had an average exposure of 55% to U.S. stocks during this period due to which we benefited, but to a much lesser extent.

“The essence of investment management is the management of risks, not the management of returns” -Benjamin Graham

Importantly, the risk profile of the S&P 500 is fundamentally different from that of the White Falcon portfolio. The index has a significant concentration and skew toward the largest technology companies. While this concentration has been highly advantageous for the index in recent years, our experience in the market has taught us that everything operates in cycles, and periods of outperformance eventually reverse. The exact reasons may only become clear in hindsight, but history reminds us that trees don’t grow to the sky. The Nifty Fifty in the 1970s, Japanese stocks in 1980s, internet stocks in 1990s, and emerging markets/commodity stocks in 2000s all serve as powerful examples.

Also, we take comfort in knowing that White Falcon’s three-year money-weighted return (MWR) CAGR stands at 18.05%. This reflects our clients’ astute timing in funding their accounts and their responsiveness to my repeated appeals to add capital during the market downturn in 2022. While this metric doesn’t directly measure the manager’s skill, it does provide insight into the average partner’s experience and the overall wealth created by White Falcon.

“The miracle of compounding returns is overwhelmed by the tyranny of compounding costs.” -John Bogle

Furthermore, we are starting to believe that this “opportunity cost” could be something like an asset allocation ETF, such as Blackrock’s XEQT. Several of our partners have joined us after previously working with financial advisors. These advisors typically allocate capital in an asset allocation strategy which, depending on one’s risk profile, will consist of say a 50% allocation to US stocks, 30% to Canadian stocks, 15% to International stocks and 5% to Emerging Markets. The more effective advisors keep costs low by using ETFs, while others rely on high-fee mutual funds or other complex products. For example, one partner who joined us recently was paying a 1% advisory fee on assets under management (‘AUM’), plus mutual fund management expense ratios (MERs) of 2.5%, resulting in a total fee of 3.5% of AUM! If you know someone in a similar situation, please have them call me immediately at 416-770-6131.

Coming back to 2024, the White Falcon portfolio has 22 positions and these break down into three categories: Compounders, Value Now and Value Tomorrow. The actual percentage division among categories is to some degree planned, but to a great extent, opportunistic and based on valuations. As of December 30, 2024, we are positioned as follows:

|

By Style |

Dec 2024 |

Dec 2023 |

|

Compounders |

25.7% |

25.8% |

|

Value Now |

41.6% |

38.0% |

|

Value Tomorrow |

26.2% |

25.8% |

|

Total Equities |

93.6% |

89.5% |

|

ByMarket Cap |

Dec 2024 |

Dec 2023 |

|

Large Cap ( > $20 bn) |

24.5% |

33.8% |

|

Mid-Cap ( > $1 bn |

53.6% |

44.6% |

|

Small-Cap ( |

15.5% |

11.2% |

|

Total Equities |

93.6% |

89.5% |

As you see above, the portfolio has shifted even more towards the ‘value today’ and ‘mid and small cap’ bucket. At White Falcon, we will always gravitate towards opportunities with low expectations and low valuations, and today, we are finding this in smaller companies which have been left behind in the market rally. However, timing is one of the most challenging aspects of this strategy. It’s often difficult to predict how long it will take for other investors to recognize and align with our view of the opportunity.

We’ve long recognized that an actively managed portfolio needs a handful of standout performers to offset the inevitable missteps that come with active investing. In 2024, while our holdings in Amazon.com (AMZN), Aritzia (OTCPK:ATZAF), Nu Holdings (NU), precious metal royalty basket, and a few others performed well, the overall portfolio was weighed down by the larger allocation to companies that didn’t perform as strongly this year. Many of our largest positions – Endava (DAVA), EPAM, Rentokil (RTO), Perrigo (PRGO), and Converge (OTCQX:CTSDF) – were flat to slightly down compared to our cost base.

“In the short term market is a voting machine, in the long term it’s a weighing machine” -Benjamin Graham

One key flaw in our execution this year is that we bought and then added to our positions too soon. We should have placed greater emphasis on buying or adding to positions as businesses began to show positive inflection points or the first signs of recovery from temporary challenges. The downside, of course, is that when a business reaches an inflection point, the market often re-rates the stock sharply, making it significantly harder to establish a position at an attractive price. However, moving forward, we will strive to refine our approach by using position sizing more effectively and prioritizing averaging up rather than averaging down.

The top 5 positions in the portfolio were: Precious Metals royalty basket, Endava, EPAM, Amazon.com, and AMD.

During the year, we sold half of our stakes in AMD and Nu Holdings as they reached their intrinsic values. However, the decline in these stocks toward the end of the year provided us with an opportunity to add to our positions.

In AMD’s case, the market has been disappointed by the company’s potential shortfall in AI chip revenues, which were previously forecasted to reach $10 billion in 2025. However, the factors required to justify the investment when the stock is priced at $220 per share are vastly different from those needed when the stock is at $120 per share. Yes, AMD’s AI chips and associated software are not competitive with Nvidia (NVDA) but this is now known and in the valuation. We believe this hyperfocus on AI ignores AMD’s other businesses where they continue to take advantage of Intel’s missteps. Importantly, AMD retains the potential to capture a small share of the AI chip market, which, given the market’s massive size, could be highly impactful for the company.

Nu has recently corrected due to Brazil’s macroeconomic struggles. Nu reports its earnings in U.S. dollars but generates revenue in Brazilian reais, Mexican pesos, and Colombian pesos. The sharp depreciation of these emerging market currencies, coupled with ongoing macroeconomic uncertainty, is making investors uncomfortable. Our due diligence suggests that Nu remains unaffected. Importantly, we continue to believe that Nu is a rare business with a combination of a large market opportunity, a strong moat driven by its superior cost structure, and a brilliant management team.

While this uncertainty in Brazil has prompted many investors to offload Brazilian stocks, we’ve taken advantage of this environment to establish a position in VALE. Vale is among the world’s largest and lowest-cost iron ore producers and boasts a growing portfolio of high-demand copper and nickel assets. It is currently trading at a P/E of 5.3x with a 8% dividend yield.

We have also significantly increased our position in NFI Group (OTCPK:NFYEF), a business that faced supply chain challenges during COVID but has emerged as one of only two bus manufacturers in North America. NFI now boasts a strong backlog and, with effective execution, is well-positioned to capitalize on this opportunity.

Our IT services holdings, Endava and EPAM, are showing positive inflections in key metrics. We believe these companies are entering a strong growth cycle, driven by the increasing need for businesses to modernize their core technology stacks in order to effectively implement AI solutions. Both holdings have significantly strengthened their operations through counter-cyclical acquisitions. In fact, EPAM made four acquisitions over the past 18 months, which, as the market cycle shifts, will substantially enhance their earnings potential.

In the appendix to this letter, we present the investment thesis on Perrigo Company plc– a consumer health company which, we believe, is close to an inflection point!

Overall, we believe that a significant portion of our portfolio companies are well-positioned for substantial earnings growth in 2025. This earnings growth, we hope, will catalyze the “pent-up” performance that we believe is inherent within the portfolio.

“Its deja vu all over again” -Yogi Berra

A key challenge in managing money in the current environment is the increasingly speculative nature in the markets. While we maintain that the “market of stocks” remains fairly valued, the overall “stock market” is currently priced in the higher quartile compared to its historical averages. Just as generals might send inexperienced soldiers to the frontlines because they are eager and unafraid, some young investors have been drawn to speculative investments or high-risk opportunities, believing they just need to “buy the dip”. While we believe our holdings are reasonably valued, cheap can always become cheaper, and a broader market correction to wring out these speculative excesses could still lead to a short-term decline in our portfolio.

We are thrilled to share an exciting organizational update! Please join us in welcoming Siddhant Kapur to the White Falcon team. Siddhant is an accounting and finance major at the University of Waterloo. He will be working with us during the winter semester, adding fresh perspectives and valuable support to our research efforts.

We look forward to his contributions as we continue to pursue our mission of delivering exceptional results for our partners.

In closing, I am truly thankful for the partnership we share. Please feel free to get in touch with me at any time for any questions, concerns, or feedback you may have.

With gratitude,

Balkar Sivia, CFA

Founder and Portfolio Manager | White Falcon Capital Management Ltd.

Perrigo Company PLC

“Almost all good businesses engage in ‘pain today’, ‘gain tomorrow’ activities”-Charlie Munger

PRGO)” contenteditable=”false” loading=”lazy”>

Perrigo Company plc, commonly known as Perrigo, is an American-Irish manufacturer renowned for its private label over-the-counter pharmaceuticals. The company’s roots trace back to 1887 when it was founded by Luther Perrigo in Allegan, Michigan. In 1887, Luther Perrigo, who owned a general store and an apple-drying business, conceived the idea of packaging and distributing patented medicines and household items to country stores. To boost customer loyalty, Luther introduced the “private label” concept, offering to print the store’s name on labels of products like Epsom salts, sweet oil, bay rum, and many other wet and dry goods at no extra cost. Perrigo established its first manufacturing facility in Allegan, Michigan, in 1921 and secured its first major private-label customer in the mid-1930s. This milestone marked the company’s transition from a re-packager of home remedies to a manufacturer of affordable healthcare products.

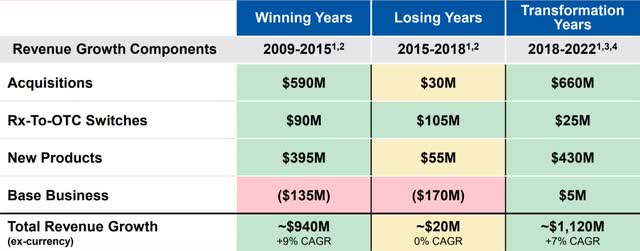

By the 1980s, the company had established itself as a key player in the private label over-the-counter (OTC) pharmaceutical market. In 1988, Perrigo went public, listing its shares on the NASDAQ stock exchange. The 1990s saw Perrigo extend its reach internationally, setting up operations in various countries and acquiring several companies to broaden its product portfolio and market presence.

Perrigo’s growth was further propelled by the advent of prescription-to-over-the-counter (Rx-to-OTC) switches, which allowed prescription products to become available over the counter. This shift significantly expanded the market for OTC products, providing Perrigo with new opportunities for growth and innovation in the healthcare sector.

Perrigo’s long-term strategy was to become a leading global provider of self-care products. The company sought to leverage its strengths in the consumer health sector rather than the more competitive and lower-margin generic drug market. The company made a significant move in 2013 by purchasing the Elan Corporation, which not only relocated its corporate domicile to Ireland but also positioned it as a global pharmaceutical industry player. The redomiciling of Perrigo to Ireland allowed the company to benefit from Ireland’s lower corporate tax rates compared to the U.S Another notable acquisition was in 2015 when Perrigo bought Omega Pharma, a leading European OTC healthcare company, further solidifying its market position.

In 2016, Perrigo acquired PBM Products for $800 million, an infant formula business, which manufactured formula for major retailers like Walmart and Kroger, as well as other private label infant formulas.

In April 2015, Mylan, known for its generics and specialty drugs, made an initial offer to acquire Perrigo at $26 billion or $205 per share. Management at Perrigo rejected this offer and the stock has done nothing but go down since! A bird in hand….

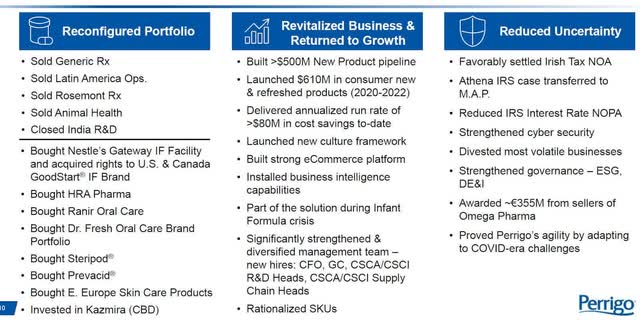

In 2016, Starboard Value became one of Perrigo’s largest shareholders, advocating for changes to improve the company’s performance and value. Starboard wanted Perrigo to focus on its core consumer self-care business including on operational improvements and divest non-core assets, such as its generic drug business. It would eventually do that, but it would take much longer than anyone expected.

In 2020, Perrigo reached a settlement with the Irish tax authorities. As part of the resolution, Perrigo agreed to a payment of $1.9 billion to settle the tax dispute which was a substantial hit to the financials. In 2021, Perrigo issued a voluntary recall of certain lots of baby formula due to potential contamination concerns and then in 2023, it faced further issues in its newly acquired infant formula facility from Nestle.

These challenges have contributed to the creation of numerous value investors who developed promising investment theses, only to see their efforts consistently thwarted by ongoing issues. In many instances, even when the investment setup starts to improve, former investors may be reluctant to re-evaluate the situation due to their prior negative experiences with the stock. The repeated setbacks can lead to a reluctance to reconsider the investment, despite evolving circumstances.

This is where the mental flexibility of renowned investors like Warren Buffett becomes particularly notable. Despite having a notably poor experience with investments in the airline industry, Buffett made another investment in the sector once he observed improvements in the industry’s structure. His ability to reassess and invest based on evolving conditions, rather than being anchored by past disappointments, highlights a crucial aspect of successful investing: the willingness to update one’s views and strategies in response to changing market dynamics.

Finally, in February 2021, Perrigo announced the sale of its generic drug business, which was part of its Rx segment, to a private equity firm, TPG Capital for $1.55 billion. Perrigo is now a pure OTC business focused on its core consumer self-care business, which includes over-the-counter (OTC) health and wellness products. By divesting the generic drug business, Perrigo aimed to streamline its operations and concentrate resources on areas with stronger growth potential and higher margins.

The company now reports two segments: Consumer Self-Care Americas (‘CSCA’) Consumer Self-Care International (‘CSCI’). Both divisions develop, manufacture, and market over-the-counter (OTC) store brand products, primarily in the cough, cold, allergy, analgesics, gastrointestinal, smoking cessation, infant formula, and oral care. However, the CSCI division in Europe and ROW actually markets under its own brand names earning much higher gross margins (50-55%) than the US division (30-32%).

Private brands are a win-win-win as retailers offer private label products at competitive prices, often lower than national brands, which attracts cost-conscious consumers while providing higher profit margins due to reduced marketing and distribution costs. However, as consumers may initially perceive private label products as lower quality, establishing a strong private label brand demands consistent quality and effective marketing efforts. Due to this, retailers are always careful with their partnerships and focus on quality and scale rather than just price.

Competitive advantages

“I think Perrigo has advantages, their size and the amount of things they’re able to produce. They definitely have a competitive advantage in that space. Anything a specific retailer wanted, they got” -Former executive at Perrigo (Alphasense transcript)

Scale and scope:

In a pharmacy, the extensive range of products is crucial for gaining national distribution with major retailers like Walmart (WMT), CVS, and Walgreens (WBA). Retailers prefer to work with companies that offer a broad portfolio of products because it simplifies the procurement process and allows them to stock multiple items from the same supplier. If a company only sells a limited number of products, it becomes challenging to convince these major retailers to carry their items, as the retailers might prefer suppliers who can offer a wider selection and meet various consumer needs.

Regulations:

The business of over-the-counter pharmaceuticals is complex due to the various FDA approvals required. The FDA’s approval process for OTC pharmaceuticals involves multiple stages and types of approvals. Each stage requires thorough documentation, testing, and compliance with specific guidelines. This process can be time-consuming and requires careful planning and execution.

Who is the consumer?

Consumers are increasingly savvy about over-the-counter pharmaceuticals, particularly in terms of cost and quality. Unlike in the 1980s and 1990s, when branded products dominated and store brands were less trusted, today’s market has seen significant growth in store brands and generic options. Consumers today – whether high income or low income – are more informed about the equivalency of products. They recognize that, for instance, both Advil and Costco’s (COST) Kirkland ibuprofen are FDA-approved and essentially the same, so they opt for the more affordable option to save money.

Revenue Growth

Perrigo revenues should grow with the category which, in aggregate, is growing at low single digits.

Perrigo is the the third largest OTC company in the US and the 8th largest OTC company in Europe.

Historically it has enhanced its growth with M&A and new product launches.

“Would I say that Perrigo is one of the most, let’s say, innovation-savvy companies? Maybe not. When it comes to innovation and creating new products based on consumer demand or market situation, I think maybe there’s companies who are doing it better. On the other hand, if you think about the acquisition and entering new categories through acquisitions or entering new categories through utilizing the footprint in the market because of the presence in multiple categories, I think definitely that’s one of the things Perrigo can do much better than many of its competitors” -Former executive at Perrigo (Alphasense transcript)

Earnings growth

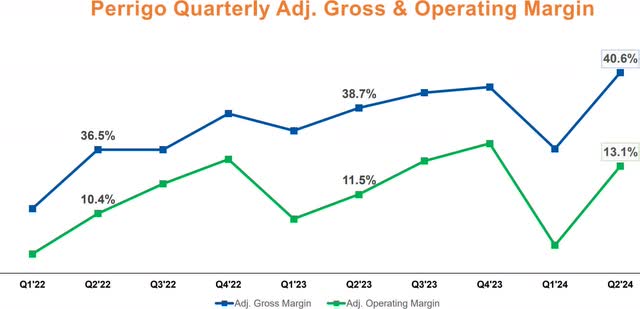

The company aims to increase its adjusted gross margin to at least 40% over the next three years. To achieve this target, Perrigo is employing several strategies:

- Global Supply Chain Reinvention Program: This initiative is expected to deliver annualized run-rate savings of $200 million to $300 million by the end of 2028. These savings will come from optimizing production processes and improving efficiencies across the supply chain.

- Integration of Acquisitions: Perrigo plans to integrate recent acquisitions, such as HRA Pharma and Gateway, which are expected to be margin accretive. For example, theintegration of HRA is projected to achieve €50 million in synergies by the end of 2024 by shifting distribution from third parties to Perrigo’s in-house infrastructure.

- Pricing Actions: The company anticipates benefits from the annualization of inflation-justified pricing actions taken in 2023/2024. It is important to note that Perrigo was behind branded players when it came to pricing and is just now catching up.

“Again, I think there were a lot of silos and a lot of duplication across the organization. Because of the acquisition of HRA Pharma who had Opill and then Compeed and a number of brands in Europe, I think the European group, branded-wise, fantastic. They’re continuing to really make progress, but I think there’s duplication across the board, and there’s some things that need to be centralized like digital and branded marketing and channel management or commercial strategy and implementation.” -Former executive at Perrigo (Alphasense transcript)

“Project Energize. Similarly, there was an investment cost to this, but you can see the $140 million to $170 million in savings by the end of 2026. Overall investment, $40 million to $60 million. But once again, this is a five-year ROI of over 80%. We are an amalgamation of several transactions, but it is critical that we streamline this company to one operating model, which we refer to as One Perrigo” -CFO at Oppenheimer conference 2024

Perrigo achieved this status early in 2024 and the benefits from restructuring are still ongoing due to which, this is probably a minimum expectation!

Turnaround of Infant Formula

Perrigo received a warning letter from the FDA on August 30, 2023, regarding their infant formula manufacturing facility in Eau Claire, Wisconsin. The letter outlined significant violations of FDA regulations pertaining to good manufacturing practices, quality control procedures, and more. These violations were discovered during an inspection conducted from March 6 to April 26, 2023. Specific issues included inadequate process controls to prevent contamination and the presence of Cronobacter spp. in several batches of their infant formula products. Despite these warnings, the FDA has reassured the public that it does not currently advise parents and caregivers to avoid purchasing any specific infant formula products from Perrigo.

“We have made outstanding progress. The large-scale plant reset at three plants that went through significant remediation that is now behind us, was completed some months ago. We have seen significant improvements in quality control, production, packaging and release attainment. To put some numbers around that, we’ve seen a 10-fold improvement in our environmental stability, which is outstanding” -CFO at Oppenheimer conference 2024

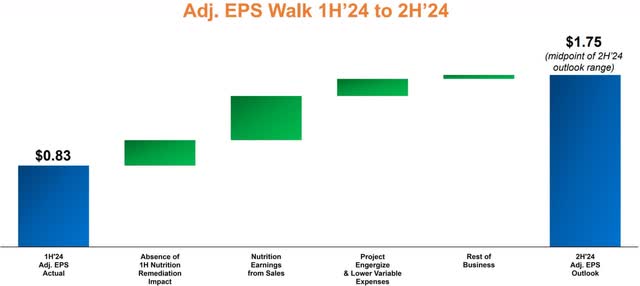

Perrigo took immediate steps to address the issues. This included halting production and conducting thorough cleaning and sanitation of their manufacturing equipment and facilities. More importantly, Perrigo spent capital in upgrading facilities so that this issue is solved once in for all. Until this upgrade was done Perrigo could not manufacture or sell infant formula! This was a bold step as this would take away the revenue and earnings contribution from their infant formula business and Perrigo would have to miss guidance. Investors, who had had a series of setbacks in Perrigo were further disappointed by ‘another’ guide-down. We believe this was the final capitulation where many value investors gave up on the stock.

“Remember, when we talked about our earnings guidance, we expected a $0.65 impact related to infant formula into our results for 2024. We’re well on track to recapturing $140 million of annual adjusted operating income in 2025, capturing all of that plus in 2026.,The key element that we are considering is building some inventory stock that’s going to be important to make sure that we can manage any shocks in supply so that demand is not impacted by that. So, we expect a significant portion of that $0.65 to recover.” -CFO during earnings call

However, in its just reported earnings, Perrigo preponed the timeline where it should see the recovery of some of its infant formula business in 2H 2024.

This means that they should do around $2.58 in EPS in 2024 and the stock is currently trading for 10x this EPS estimate.

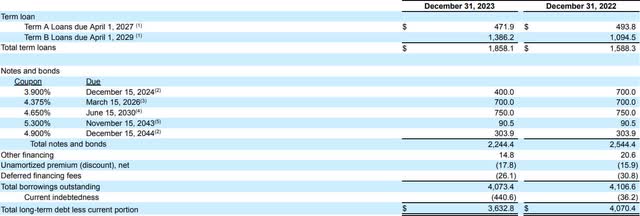

Perrigo’s balance sheet has been leveraged but the maturities are spread out and coupon rates are relatively low:

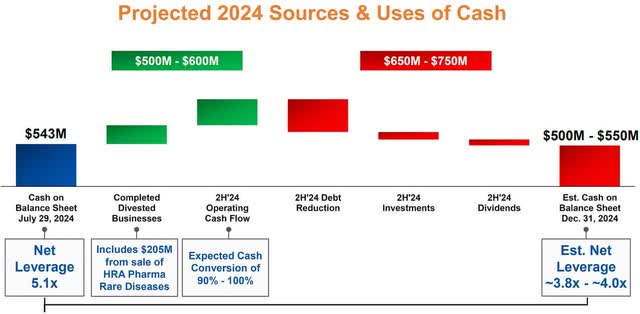

Importantly, Perrigo is a very cash generative business and has plans to aggressively pay down debt over the next few years:

Free option – Opill

Perrigo launched Opill which is a progestin-only oral contraceptive pill, which, unlike combination birth control pills, contains only progestin and is suitable for a broader range of women. In 2023, Opill received FDA approval as the first over-the-counter (OTC) birth control pill in the United States. This makes contraception more accessible without a prescription. Opill enhances access to birth control for many women, including young women, those without health insurance, and individuals in areas with limited healthcare services.

Launching an OTC birth control pill requires significant educational and marketing efforts to ensure proper use and integration into broader healthcare conversations. Due to this, Opill is currently dilutive to earnings but management expects it to start contributing to earnings in 2025-26. We believe that there is a significant market opportunity for a pill like Opill and this should contribute meaningfully to Perrigo’s results in the near future.

Going forward, one can expect:

Organic net sales growth in the low to mid-single digits Earnings will grow faster due to operating leverage and cost cutting programs. In addition, the full force of infant formula and some contribution from Opill means that EPS can hit $3.25-3.50 in 2025/26. After that, a HSD percentage growth in adjusted operating income and a higher low-teens growth in EPS due to debt paydown and lower interest expense

Due to all this, we believe that Perrigo should be trading at a 14-15x multiple of this $3.50 in earnings in 2025/2026 leading to a projected share price of $50 which is close to a double compared to the share price today.

Management

Murray S. Kessler was appointed the CEO in 2019 and played a big part in leading the company through various strategic initiatives. Kessler was the Chairman and CEO of Lorillard, Inc., a major tobacco company.

Patrick Lockwood-Taylor took on the roles of President, Chief Executive Officer, and Board Member of Perrigo starting June 30, 2023 and has been instrumental in its turnaround. Prior to joining Perrigo, he was the Regional President of Consumer Health North America at Bayer AG, where he also held the position of President of Bayer U.S. His career includes over two decades at Procter & Gamble, where he held various brand franchise and general management roles.

“Now, the good news is I think Patrick Lockwood, who became CEO right as I was leaving, comes from a branded background and comes from P&G. I’ve watched the executives that they’ve hired, and I’m like, “Maybe they’re turning the corner because those are executives who understand the branded game and understand where the investment needs to go.” -Former executive at Perrigo (Alphasense transcript)

Perrigo is an execution heavy business (that no ham sandwich can run) and has chewed through CEO’s in the past. We believe Patrick is doing the right thing and comes from the right background for this opportunity. The decision making at Perrigo has been much improved where they are making the right decisions for the company on a long term basis since the appointment of Patrick. We believe he will see this through and increase the quality of the business over the very long term.

Conclusion

Perrigo stands out as a high-quality business due to several key attributes that contribute to its strong market position. Perrigo has a diversified portfolio focused on consumer self-care products, including over-the-counter medications, nutritional products, and infant formula. This diversification helps mitigate risks associated with dependence on any single product category. Moreover, Perrigo’s scale and scope as well as its experience with various regulatory bodies and extensive manufacturing and distribution network helps build a moat which is difficult for competitors to match. We are at an inflection point where Perrigo’s earnings should rapidly increase and this, along with an appreciation of its business model, should help re-rate the stock. Finally, Perrigo has shown resilience – even with all the disappointments – with consistent revenue and profitability. Its ability to generate strong cash flows supports dividend payments to shareholders and should help de-lever the balance sheet in a rapid manner.

#White #Falcon #Capital #Partners #Letter