One of the country’s top fund managers, dubbed by some financial experts as ‘son of Neil Woodford’, insists his ‘well-tested investment process’ will eventually come good.

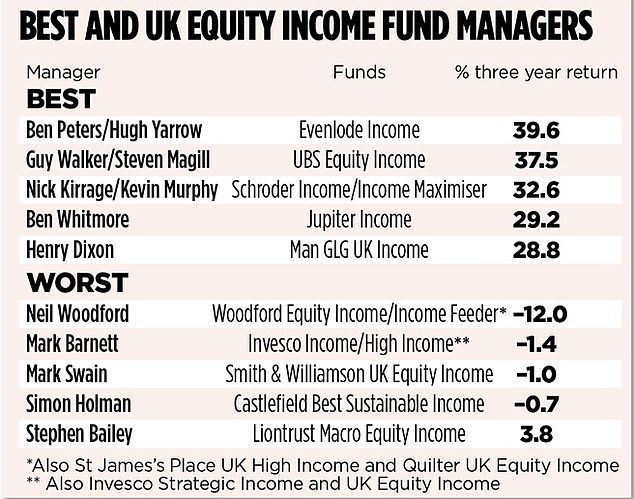

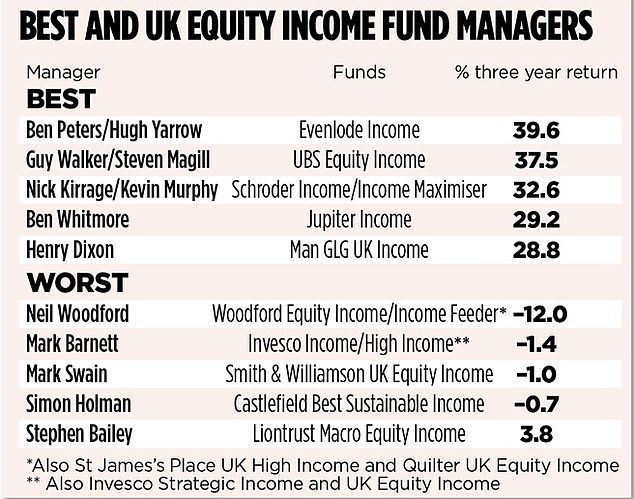

The claim, made by Mark Barnett of major investment house Invesco, comes as the latest performance statistics show he is delivering returns for fund investors way below those of all his immediate rivals bar Woodford.

Barnett replaced Woodford as head of UK equities at Invesco in early 2014 after the latter set up his own investment group. He now manages Invesco Income and High Income, the two multi-billion pound funds previously run by Woodford, as well as two other UK-focused funds and investment trusts Edinburgh and Perpetual Income & Growth.

Others describe him more cruelly as the ‘David Moyes’ of Invesco, as big a let-down as Moyes was when given the job of succeeding Sir Alex Ferguson at Manchester United.

Patrick Connolly, a chartered financial planner with Chase de Vere, continues to hold Invesco Income and High Income for clients. But he has not recommended the funds for more than a year.

He says: ‘Barnett has underperformed significantly. This is for a number of reasons including a focus on domestic UK companies that have been hurt by a weak sterling.’

On Friday, Invesco acknowledged that Barnett’s underperformance had resulted from the funds’ exposure to sterling and UK-sourced revenues, a refusal to invest in mining companies (which had performed strongly), and ‘isolated stock challenges’.

But it remains convinced the most compelling investment opportunities within the UK stock market are be found in the domestic sectors that Barnett’s funds are heavily exposed to.

It added: ‘Mr Barnett continues to evaluate and re-evaluate the holdings in the funds, seeking the best opportunities to create a sustainable flow of dividend income. He believes at a time of irrational market pricing, it is vital he remains rooted to his investment strategy.’