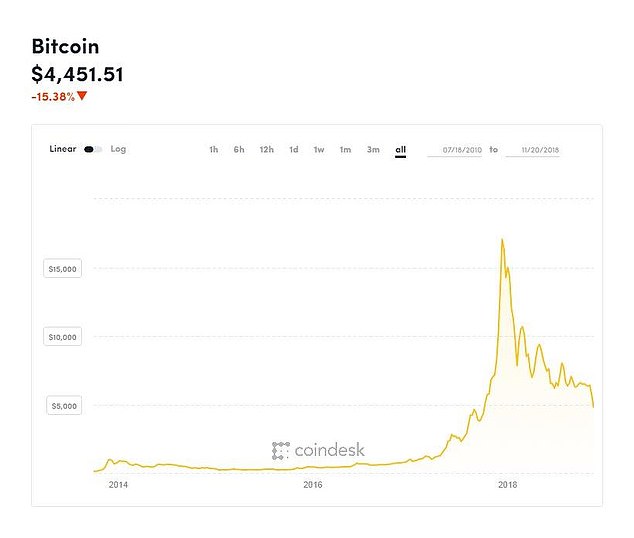

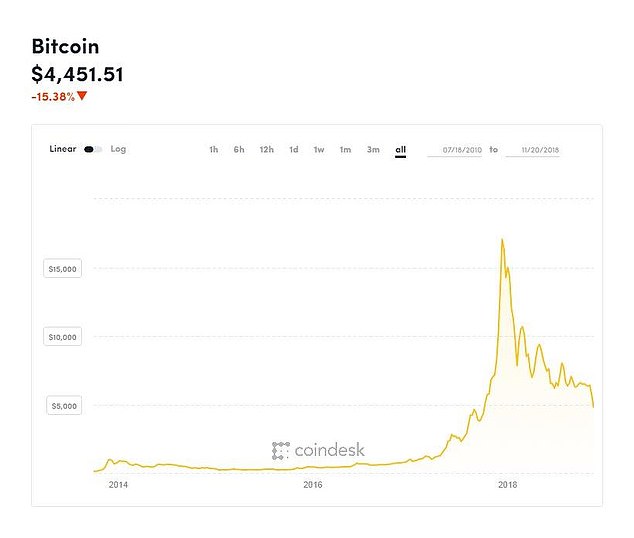

The price of bitcoin plunged to a 13 month-low, leaving many punters who jumped onto the crytocurrency bandwagon last winter sitting on substantial a paper loss.

Billions of dollars have been wiped from the value of the original and best known cryptocurrency in the past week alone, having tumbled by over 30 per cent to $4,450.

The coin hasn’t traded under $5,000 since early October last year when it reached the milestone amid its meteoric run-up to an all-time of $19,343 just before Christmas.

Highs and lows: Bitcoin has fallen to a 13 month low – down from a peak of $19,343 in mid-December last year

Until last Wednesday, bitcoin had managed to maintain a two month period of relative stability relatively trading between the $6,000 and $7,000. But the recent fall will be grist to the mill for those who think that bitcoin and other cryptocurrencies can’t be classed as credible investments.

Ben Yearsley of Shore Financial planning said: ‘Quite simply it isn’t an investment proposition. It never has been. It’s pure speculation.

‘I’m not a fan of cryptocurrencies as they are for short term speculating and trading and not for proper investors.’

Mati Greenspan, analyst at online broker eToro, disagrees. He said: ‘In the same way previous cycles have not signalled the end for broader markets, these price movements don’t signal the end for cryptoassets.

‘We’re still very much at the beginning of the crypto journey. At this stage, volatility is to be expected.’

He added: ‘What we’re seeing now are the after-effects of the unprecedented rise of bitcoin and other cryptoassets seen in 2017. This year is simply a retracement of that.

‘The same is happening in broader markets as well where tech stocks, for example, are following a similar pattern.

‘As with all markets, if prices reach levels that are higher than can be justified they need to pull back. These cycles can sometimes be accentuated in the crypto market due to the riskier nature of this nascent industry.’

If you do buy into bitcoin

Find out how bitcoin and the blockchain works, so that you have some understanding of the system, the ledger, the major players and the public and private key elements.

Remember bitcoin yields nothing and its main source of value is scarcity. Most bitcoin activity is trading not investing.

Research coin wallets, the digital vaults where cryptocurrency is held, and consider security carefully. Bitcoins have been stolen before, understand how this happened.

Be prepared for extreme volatility. The price can move by 20 per cent in one day and you could easily lose half of your cash in a far quicker time that investing in the stock market.

Consider how you would cash in any gains. There are reports that this has proved hard for some people. A time of market stress could lead to people being locked in and unable to trade.

Read our guide to How to be a successful investor, which looks at the far less high octane world of long-term investing and how to make it a success.

What is bitcoin?

The digital currency that most will be familiar with is free from government interference and can be shared instantly online. It doesn’t rely on trusting one central monetary authority.

The underlying technology is blockchain, a financial ledger maintained by a network of computers that can track the movement of any asset without the need for a central regulator.