When investing it often pays to do the opposite of what others are doing.

Of course, there are some caveats to this. Most investors will tell you they are a contrarian – and they can’t all be. Meanwhile, adopting a strategy of just buying all the rubbish others are selling is not necessarily a winner.

Nonetheless, swimming against the tide has a history of success.

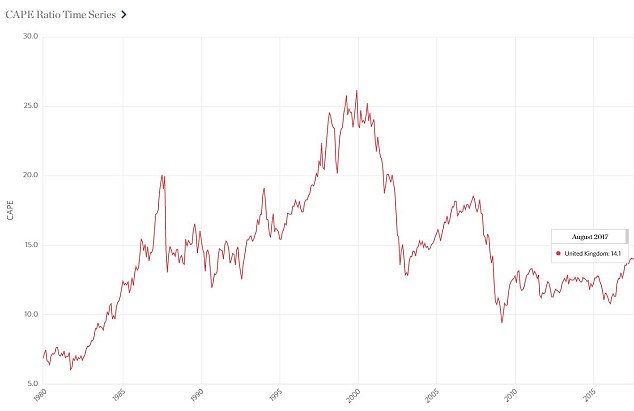

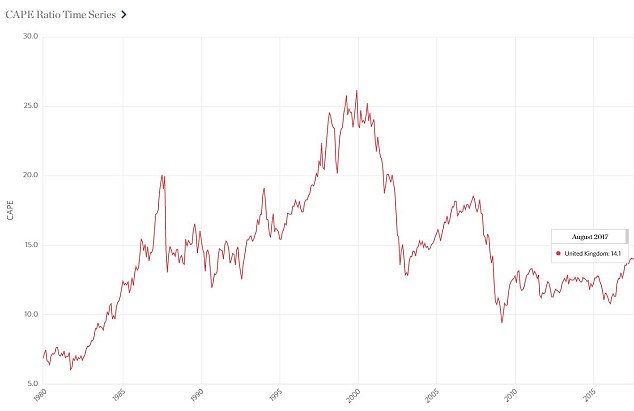

This chart using Research Affiliates data shows the UK stock market’s CAPE ratio at 14.1 at the end of August 2017, which stands at about the long-term median. This makes the UK market neither cheap nor expensive historically, indicating decent but not knockout returns

The problem with the contrarian scenario is that unpopular as it is, the UK stock market isn’t particularly cheap.

The price to earnings ratio is flashing red at 31, according to data from Star Capital, while the longer-term view offered by the CAPE ratio (cyclically adjusted price to earnings) shows a reading at the end of August of 14, pretty much on the long-term median, according to Research Affiliates data.

I prefer to pay more attention to CAPE’s ten-year view than the volatile one-year PE ratio and it bodes well for decent but not spectacular returns.

While I’m more of a fan of the long-term growth potential of Asia’s emerging middle-class – and not entirely convinced we’ll pull off Brexit without shooting ourselves in the foot – the fact that others don’t like the UK interests me.

I’m interested particularly in the bits of the UK that people don’t like, so I will be looking for some investment trusts and funds with a value or recovery perspective.

I wouldn’t bet my flat on it, but buying a bit more unloved stuff in the unloved country doesn’t seem a bad idea.