Do you own any gold? Beyond the wedding ring on my finger, I don’t.

I get the reasons for buying it, from a long-term store of value, to the idea of it as an investment insurance policy, but I’ve never taken the plunge and stuck some in the Minor Investor portfolio.

Recently though, I’ve been wondering whether this is a mistake. Should I perhaps buy some gold?

Thw world’s most famous investor Warren Buffett isn’t a fan of holding gold

It’s been called a hedge against high inflation and a defence against fickle modern-day money, but really gold tends to rise substantially when people are very worried.

This is where the idea of investment insurance comes in. You stick 10% of your portfolio in gold and that really pays off is when everything else is tanking.

For much of the time, gold’s price will remain in the doldrums, and quite possibly drift lower, but when things get really bad it should jump. Look at how this happened in the financial crisis.

Interestingly, Buffett wrote that letter just as gold properly came off the boil. Today, it’s still down a third in US dollar terms on its 2011 peak above $1,900.

Demand remains robust, but there’s not enough at the margins to boot the price up again. To find out who is currently buying gold and why, I invited Adrian Ash, of BullionVault, onto the Investing Show, which you can watch below.

If that prospect of cheaper gold sounds good, there is one slight problem if you are a British buyer. The price in pounds is nowhere as far off the peak in sterling as it is in dollars.

Gold is priced in US dollars and although that dollar price fell after a summer peak for the year, sterling’s post-Brexit vote slump means that gold still returned a hefty 30 per cent in pounds last year.

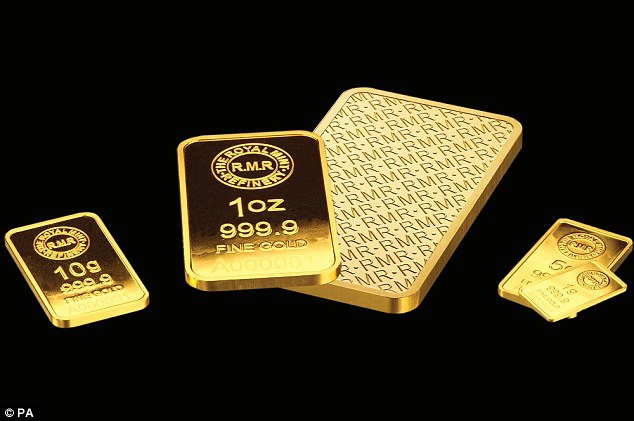

At the time of writing an ounce of gold will cost you £945, compared to about £1,130 at the 2011 all-time high. So gold in sterling is off about 16 per cent from that peak.

So why think about buying some now?

Firstly, something bad happening is still an outside chance, but one that seems more likely. Secondly, back in 2011, everywhere you turned investors were thinking about buying gold, and now that’s not the case.

Gold is still in demand, but it will be much more in demand if something bad happens.

Buffett said: ‘Admittedly, when people a century from now are fearful, it’s likely many will still rush to gold. I’m confident, however, that the $9.6 trillion current valuation of pile A will compound over the century at a rate far inferior to that achieved by pile B.’

Overall, I agree with Buffett.

Gold isn’t an investment, it’s a bet on people freaking out. But I do wonder whether that insurance might be worth buying at the moment.