They say men are from Mars and women are from Venus, but does that really matter when it comes to our money?

Do women need to think differently about their savings, investments and retirement? The short answer is, yes.

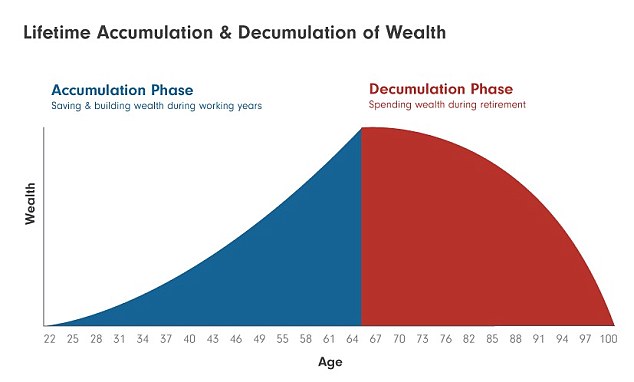

Much like a car accelerates and decelerates, in life we have our ‘accumulation’ years – the time spent building our wealth by working, saving and acquiring assets like a property.

Once we reach retirement, we enter the ‘decumulation’ phase, drawing income from the savings and pension pots we have built up during the accumulation years.

What you’re left with to ‘decumulate’ once retirement sets in, will to a large extent be a result of what you’ve managed to ‘accumulate’ during your working years.

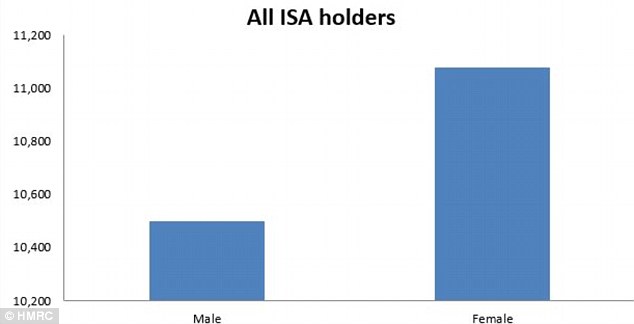

And, here’s the rub: women face very different challenges to men in their accumulation years, which ultimately impacts how much they’re left with one day.

Women are likely to live longer than their male counterparts – so they need to make sure they have enough savings

Forget until death do us part, these days it’s more likely, until retirement. For both men and women, the average age of divorce has been rising by about three months every year over the past decade – it’s up around 10 years since records began in 1950.

People are marrying later in life and living longer and as a result are more exposed to divorce at older ages. Divorce is also no longer seen as the social taboo that it once was. These factors have given rise to the so-called ‘silver separators’ – from 1990 to 2012, those aged 60 and above filing divorce papers rose by more than 85 per cent.

Whatever your age, a divorce can be stressful and burdened with financial worries, not least of all having to face the acrimonious task of splitting your assets. For the over-60s, the financial ramifications can be devastating.

Women, who have been stay-at-home mums or let their husbands manage the finances during a long marriage, need to ensure a fair separation of wealth.

Where the main pension holder and breadwinner is the husband, ex-wives are often awarded a one-off lump sum or matrimonial home to manage.

But substituting a pension income for a property can be risky and a very short term strategy – a far more prudent approach is splitting the pension pot – there are different routes you can follow and it’s important to understand each option.

Most importantly, women need to invest and have financial plans in their own right. If you are raising children and managing the family home it is unlikely your savings and pension benefits will be vast.

Remember ladies, you’re likely to live longer than your male counterparts, so make sure retirement savings last for as long as you do.

Maike Currie is Investment Director at Fidelity International and the author of The Search for Income – an investor’s guide to income-paying investments. The views expressed are her own. @MaikeCurrie