Tanya Jefferies for Thisismoney.co.uk

|

Updated:

09:32 GMT, 11 July 2018

Investment managers have to produce factsheets of important details like charges and performance for each of their funds in a standard format that makes them easy to compare.

Known as KIIDs – it stands for key investor information documents – they were made compulsory by the EU some years back to help people understand investment products and their risks better.

They are just a couple of pages long and are uniformly bland in style. Nevertheless, they can be a useful starting point for researching and comparing funds.

DIY investing guide: A financial expert explains which bits of a KIID document are actually important, the parts investors are free to skim, and what important information they leave out

Investment trusts, which are traded as shares instead of pooling investor money like in a fund, were made to start producing similar documents from the start of this year.

Theirs are called key information documents or KIDs, and have to provide more detailed information about potential performance if you invest £10,000 under different market scenarios – stress, unfavourable, moderate and favourable.

More…

What should you know before buying an investment trust? The DIY investors’ guide

Watchdog promises new easy to use ‘directory’ to help people find reputable financial firms and advisers

But the figures are based on past performance, and this requirement has generated controversy amid claims this information will mislead investors.

We go into this and explain how to get the most out of the new investment trust KIIDs here.

Investment fund managers will have to revamp their KIIDS to provide the same kind of performance and charges information as investment trusts from the start of 2019, but for now they remain the same as before.

All investment fund KIIDs have five sections:

* Objectives and investment policy – the aim of the fund;

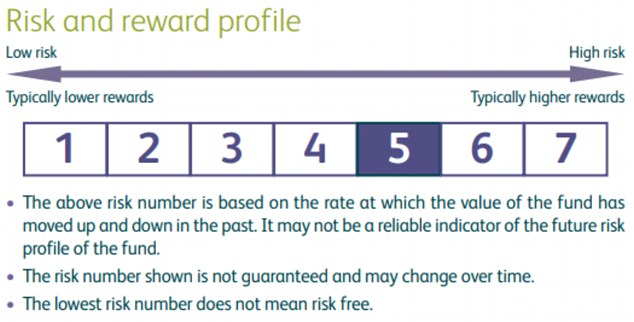

* Risk and reward profile – level of risk in relation to the potential reward, and any specific fund risks;

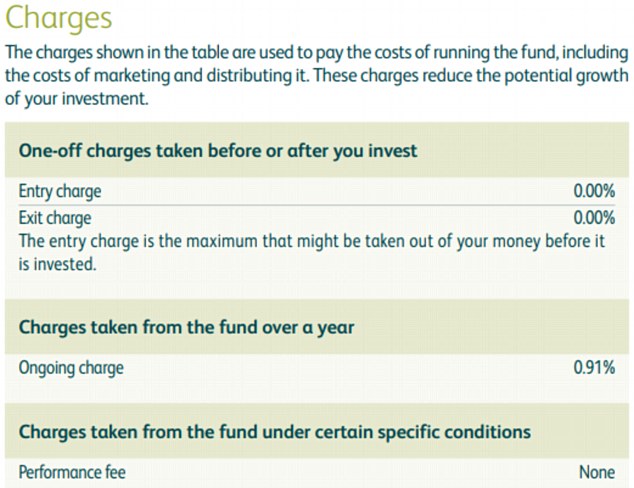

* Charges – fees that apply to the fund;

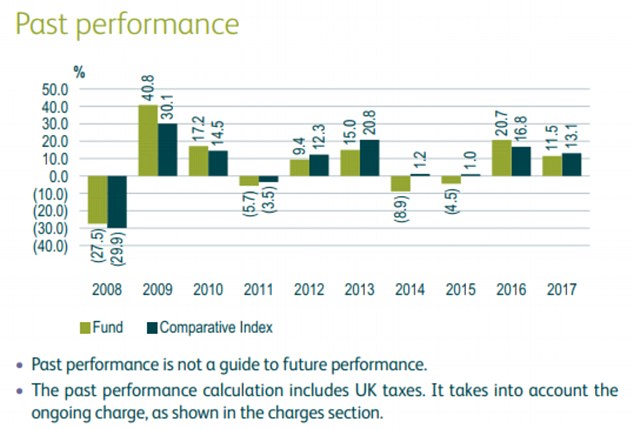

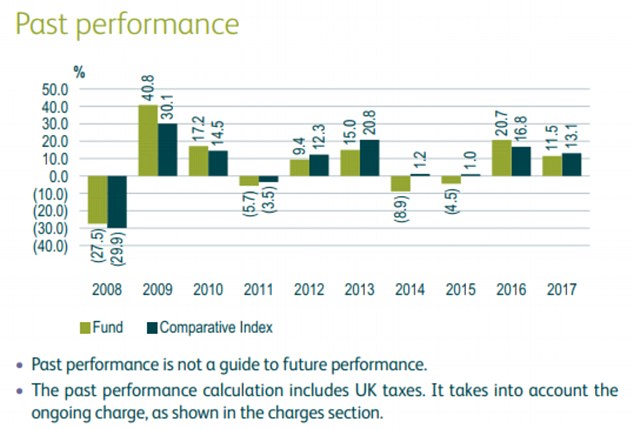

* Past performance – depending on when the fund launched you’ll see past performance since launch, over five years or 10 years, but this is not a guide to future performance;

Source: M&G Investments

Practical information

This just contains technical details, says Haynes.

What does a KIID leave out?

‘It’s still a very brief document. The factsheets from fund managers on investment platforms provide a greater level of information and a snapshot of where a fund is currently invested,’ says Haynes. ‘Use a KIID in conjunction with fund managers’ own literature.’

You can find out additional information on many money websites, including at This Is Money’s fund centre.

Haynes says investors researching a fund should also check the following:

Who is the fund manager?

Find out how long the manager has worked at a fund – this will tell you whether periods of outperformance were down to them or a predecessor.

Haynes notes that M&G Recovery’s manager, Tom Dobell, has a long track record with the fund having taken it over in 2000.

What about socially responsible investing?

A fund’s ‘objective and investment policy’ should cover any socially responsible goals, if you are interested in seeking out ethical investments.

But these sections of KIIDs are light on detail, and might not even mention a fund’s credentials in this area unless it’s an important part of its investing strategy. You should therefore check out providers’ own factsheets to find more information.

Read more here about how to track down the best ethical funds and savings accounts, and check out this edition of Big Money Questions for more about sustainable investing.

What is the income?

KIIDs don’t tell you a fund’s yield – its income return from dividends – if there is one. M&G’s is 1.24 per cent at the time of writing.

What are the fund’s current holdings and what sectors are they in?

M&G Recovery’s top 10 holdings are large UK blue chip companies in sectors like oil and financials.

What is the size of the fund?

M&G Recovery was launched in 1969 and it currently holds £2.9billion of assets. Read more here about the size of funds, and the implications this has for investors.

What is the minimum investment?

‘That is one of the first things investors might want to see,’ points out Haynes.

Unfortunately ‘clean’ fund factsheets often display misleadingly large figures because they double up for use by big institutions, like pension funds, as well as ordinary investors.

M&G’s says the minimum investment is £500,000.

However, you can generally find the actual minimum investment for individual investors on the old ‘unclean’ fund factsheets, which still bundle up the investment fund fee with adviser and admin fees.

M&G’s one puts the minimum investment at a much more reasonable £500.

As a rule of thumb, ‘unclean’ versions of funds that were targeted at individual investors are usually tagged ‘A’ or ‘R’. If you are unsure, fund firms should easily be able to tell you their minimum investment figures.